Categories

NEWS: Why are House Prices Falling in Investment Hotspots?

House prices are beginning to fall and investment hotspots that were seeing the biggest growth before 2022 are now on a decline - we explain why.

In the past year, house prices in the UK have fallen -0.2%, bringing the average house price to £263,800.

That's £410 lower than a year ago. While this decline isn't substantial, it illustrates a lack of growth in the British property market and that it's struggling to leave the slump it experienced in 2023.

Related: The 9 Best Places to Live in the UK & Can I Get a Mortgage for 5 or 6 Times My Salary?

Find the Perfect Mortgage

Skip to:

Where in the UK Are House Prices Falling?

Why is Property Value Dropping in Some Regions?

Is The UK Leaving The Housing Slump?

Finding an Affordable Mortgage

Where In the UK Are House Prices Falling?

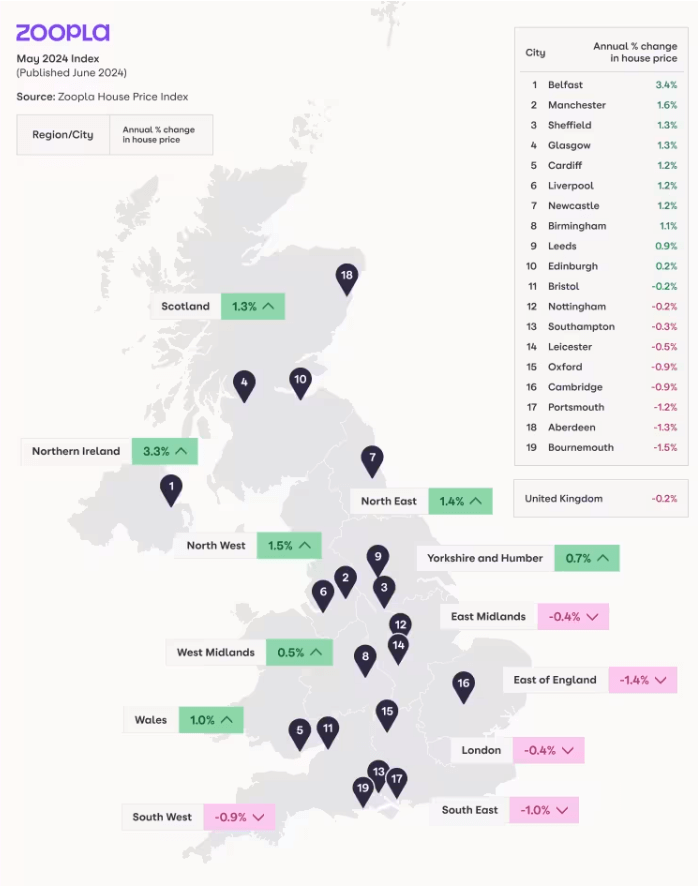

The South of England is seeing the largest house price falls across regions and cities, while some other regions are still seeing growth (just at a slightly slower pace than before 2022).

Northeast, Scotland and Northern Ireland are seeing the biggest yearly increases (1.3%, 1.9% & 4.4% respectively), but this still this is only incremental compared to the 25% increase (over £63,000) observed in Cornwall between November 2020 – November 2022.

East England is seeing the largest annual property value drop at -1.7%, and the Southeast is following closely behind at -1.6%.

Growing cities like Bristol, Birmingham and Edinburgh have remained fairly static in the past year. Bristol has dropped by a minute -0.5%, and Birmingham and Edinburgh have surpassed 0.5%.

Scotland is the only region in the UK where house prices have continually risen amidst last year's housing slump.

Zoopla's infographic below shows where in the UK property value is rising and falling.

Why Is Property Value Dropping in Some Regions?

The UK as a whole is experiencing limited purchasing activity due to a lack of affordability brought on by inflation. Increased interest rates and elevated house prices compared to the average wage means buyers have less disposable income to save up for a large deposit and are being priced out of certain areas. This, combined with high living costs, has led to less buying activity and slow market growth in 2024.

The Bank of England base rate was raised to 5.25% in August 2023 to combat inflation, the highest it had been in 16 years, putting buying a home out of reach for many across the UK.

Sellers have been reducing their asking prices due to a lack of buying activity, even in competitive markets like London and the Southeast, as well as growing cities.

Some regions saw high demand during 2020 – 2021. The uber-low bank rate of 0.1%, additional household savings from working from home and a desire to be closer to nature due to the COVID-19 pandemic caused property value to skyrocket in some areas, which is now dropping as the property market re-adjusts.

In areas like the Southeast, London and Oxford, affordability is the primary reason that property value is dropping slightly. First-time buyers and young families are being priced out of London, where the average deposit for a first-time buyer is £144,000.

See similar: Guide to the Most Expensive Streets in the UK

See the latest market news below.

House prices are rising, but not as rapidly as they were before 2022. In 2024, we did see a modest rise in house prices, but since the budget, this has come down slightly. The Bank of England base rate has dropped, but mortgage deals don’t seem to be moving in response to the Autumn Budget, which has since been widely considered inflationary. As the housing market begins to recover from the past four years of economic turbulence, there seems to be a case of push and pull between house prices and interest rates restricting affordability. Limited affordability has caused a visible divide between the UK’s most and least affordable housing. And unfortunately, in more expensive areas, first time buyers aren’t getting to enjoy much of a drop in house prices because the difference is made up by high interest rates and less favourable mortgage deals. Mortgage rates have come down slightly from their 15-year high, and while the housing market does seem to be on the mend, it’s still not the easiest time to buy property for first-time buyers and investors alike. For buy to let investors, regulations have gotten stricter since 2022, and high mortgage rates have thinned profit margins, making owning a standard buy to let a trickier affair than a decade ago. While house prices have dropped slightly due to lack of affordability across London and the rest of the South, this isn't the case in other regions. But this isn't the case everywhere in the UK. The North of England has seen entirely different purchasing behaviour to the South since the early 2000s. In select areas, particularly Yorkshire, North Lincolnshire and Durham, you can still easily buy a property for under £100,000. Due to affordable housing and cheaper living costs in these areas, most of Northern England and Scotland have been resistant to the housing slump that the rest of the UK has experienced in response to high mortgage rates. The property market in these regions has remained robust and has seen growth throughout 2024. There's certainly hope, both for property investors and those looking to get on the housing ladder. If you're looking to invest in a buy to let in 2024, it may be worth looking in affordable areas with a consistent rental demand, such as university towns or areas close to large employers. Property hotspots like these are still reaping generous rental yields while the rest of the country is seeing slow growth. For first-time buyers, house prices coming down significantly could make it much easier for them to get on the housing ladder, but in many cases, house prices going up is beneficial for those using equity in their homes to make another purchase.Where Are the Most Affordable Places in the UK to Buy a Home?

Is The UK Leaving The Housing Slump?

House prices are slowly recovering month-on-month. As hints of a summer bank rate reduction loom over the nation, more first-time buyers and investors are taking the hit with interest rates and taking advantage of the dip in property prices.

But while some buyers are in a position to take the leap, it remains a buyers’ market, with a number of properties taking over a year to sell.

It’s difficult to say whether property prices will continue to heal from the economic turbulence the UK has undergone in the past four years.

House prices may be picking up, but data shows that the real value of homes (property value relative to inflation) has declined significantly since early 2021.

Some economists argue that the low interest rates the UK has been experiencing since 2009 are an anomaly and a key driver in keeping house prices high for the past 15 years.

But either way, while it's likely that a base rate reduction is on its way, it's also possible that the super-cheap borrowing we saw between 2020 - 2021 is a thing of the past.

Read blog: UK's Top 10 Rental Yield Hotspots for Landlords

What Do The Experts Say?

George Abouzolof

Senior Finance Broker CeMAP

The immediate impact of a 0.25% reduction will be a drop in mortgage payments for those on base rate trackers. Paying 0.25% less on a £1m interest-only mortgage equates to £2,500 less per year. So, the savings across the mortgage industry could be huge.

Fixed rates are unlikely to follow suit unless government bond yields relax - which they have done month-on-month. Most borrowers are opting for two-year fixes in the hope that rates will continue to drop in the future.

Relations with the US could pose a threat to the economy’s recovery. Trump is highly US-focused, and is prioritising American brands, as well as removing incentives for sustainable tech. This could make trade with US more difficult.

There are signs that US administration could go on a spending spree, which could also have a knock-on effect on us.

However, the overall sentiment has been much more neutral than we might have expected. While some landlords have been put off, for many, it’s business as usual. Investors are looking where they can to make a profit and overcome the current climate.

We’re still seeing a steady influx of first-time buyers and buy-to-lets, which could be a sign of the anticipated rush to purchase ahead of the upcoming stamp duty changes.

Furthermore, we haven’t seen a decrease in foreign investment so far, despite claims that the Autumn Budget would impact this.

And how about our readers?

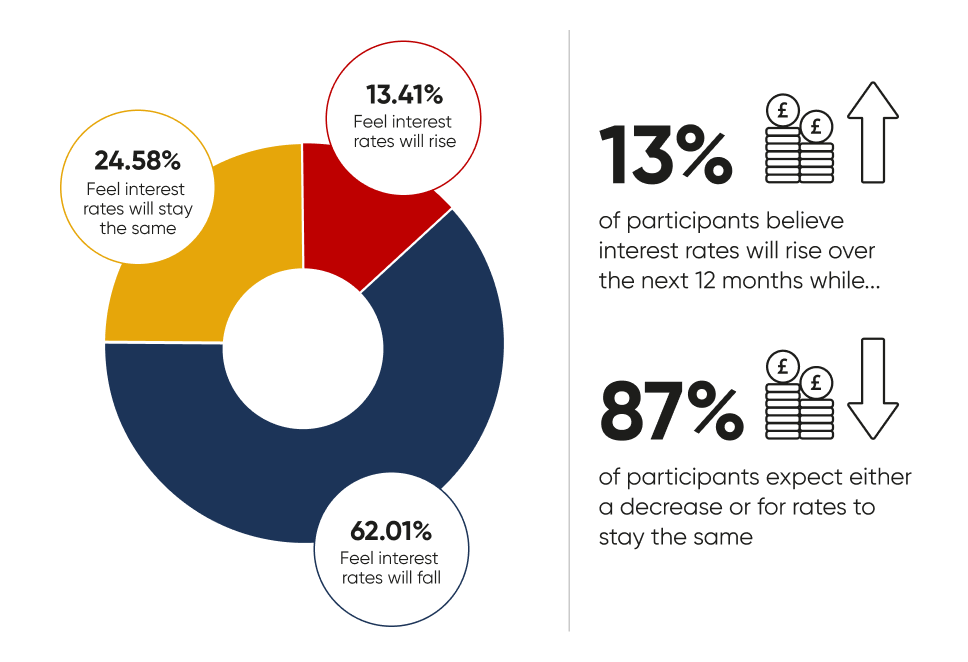

Just 13% of participants believe interest rates will rise over the next 12 months, while 87% expect either a decrease or for rates to stay the same.

This sheds some light on the fixed or tracker mortgage debate for first-time buyers and those remortgaging in the next coming months.

This sheds some light on the fixed or tracker mortgage debate for first-time buyers and those remortgaging in the next coming months.

Read our full survey results »

How Can You Find an Affordable Mortgage in 2024?

Despite current optimism about declining mortgage rates, deciding on the best option can be daunting.

We can help you compare mortgage products and their costs to find the best deal for your specific situation from a wide range of lenders nationwide.

Expert mortgage advisors have their finger on the pulse of the latest mortgage market news. Whether you're a first-time buyer, looking to refinance, or investing in a BTL, we can help you understand your mortgage options so you feel confident you're making the right choice.

To see what we can do for you, give us a call at 0203 900 4322 or book a free consultation below.