Mortgage Pulse Report 2024

Real Insights Into Public Opinion Of The Mortgage and Property Markets

The CPF Mortgage Pulse Report 2024 results provide insight into public perceptions regarding interest rates, mortgage repayments, house prices, and the housing crisis debate in the UK in 2024.

Published: 28/03/2024

Methodology: The research was conducted through over 500 form fills on the Clifton Private Finance website between November and March, which attracts thousands of monthly visitors seeking information on property and property finance. This method ensured a diverse and relevant audience for the study. Survey questions included topics surrounding mortgage rates, mortgage repayments, house price trends, the housing crisis debate, and each participant's annual income for comparative data.

The Key Findings

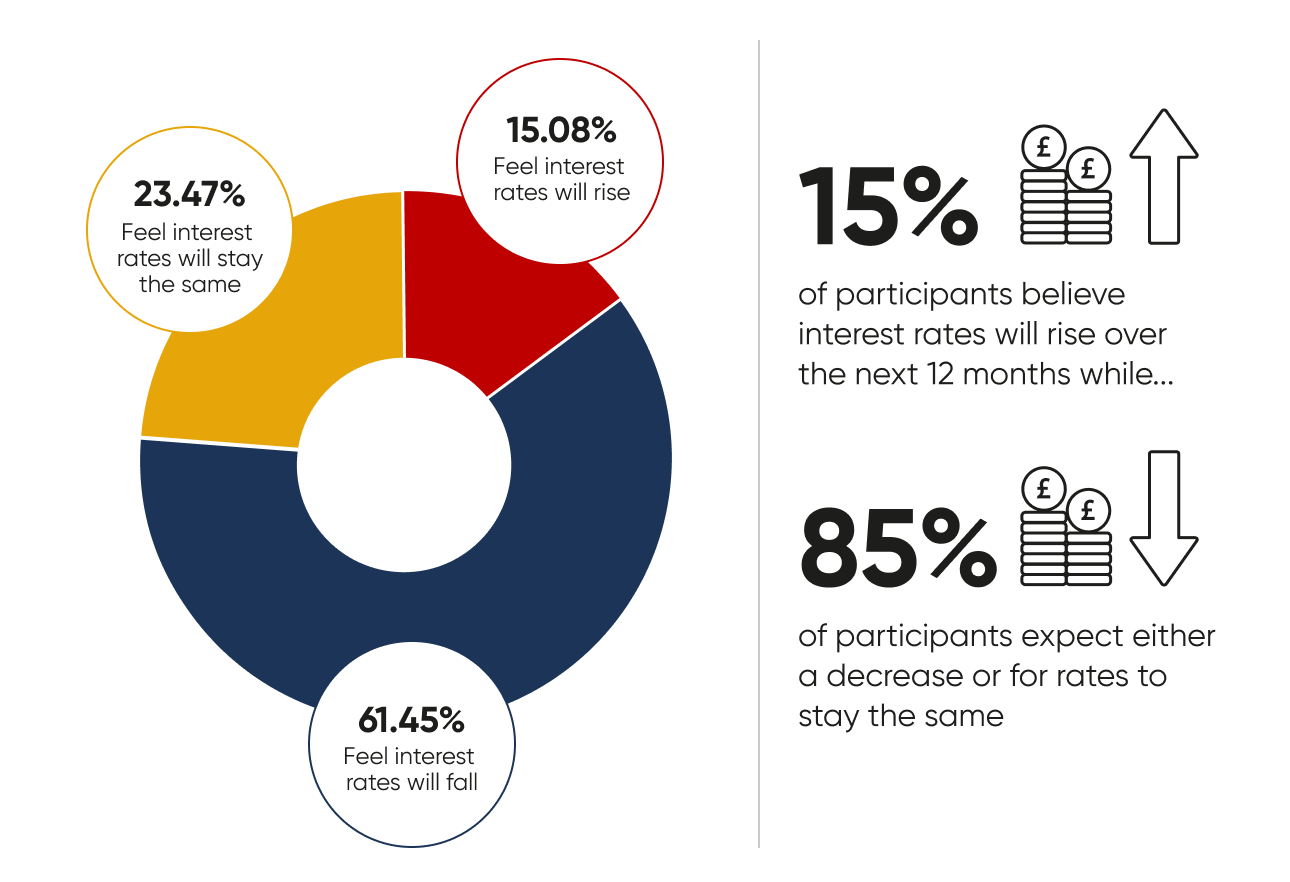

Over 85% of those surveyed don’t think interest rates will rise in 2024

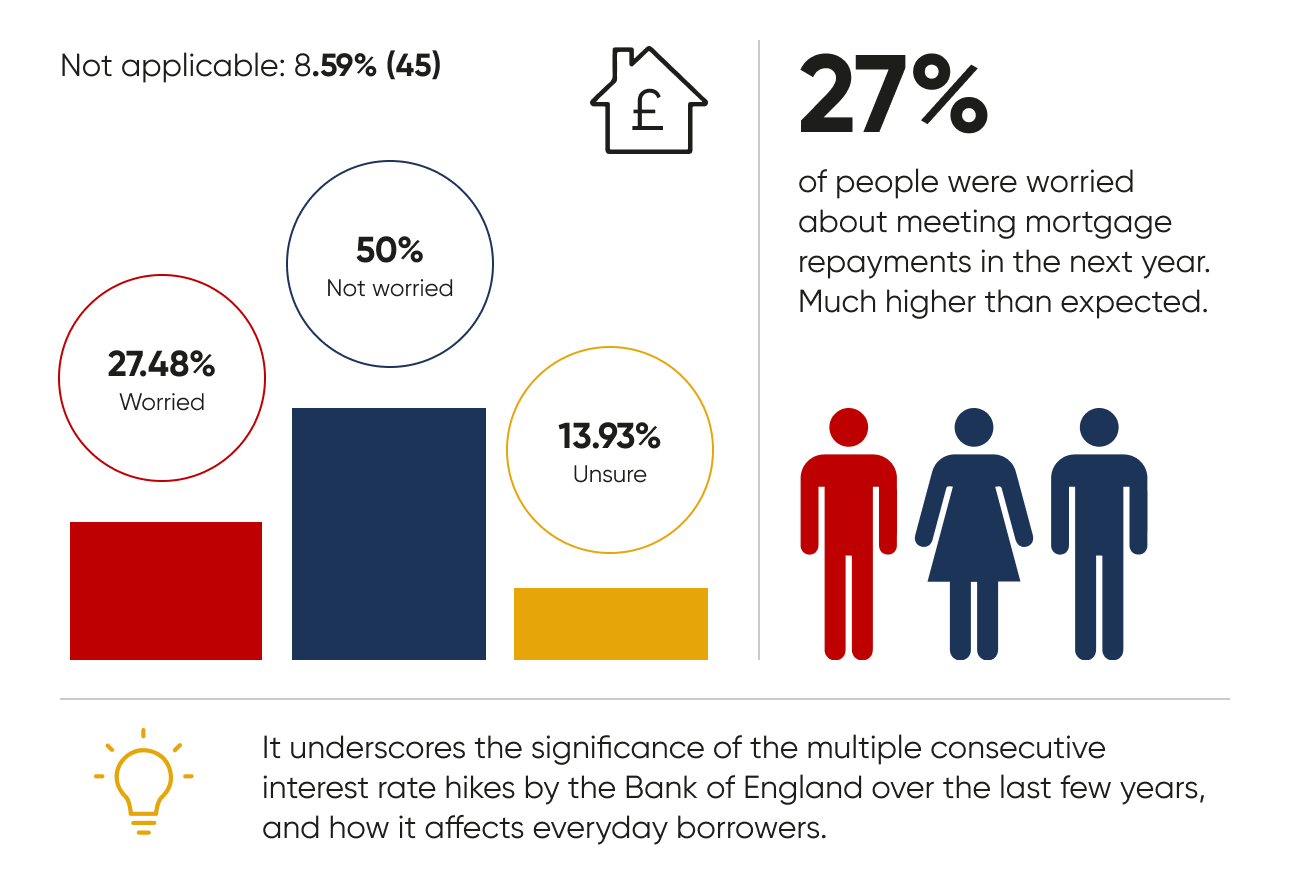

1 in 3 are worried about keeping up with their mortgage payments

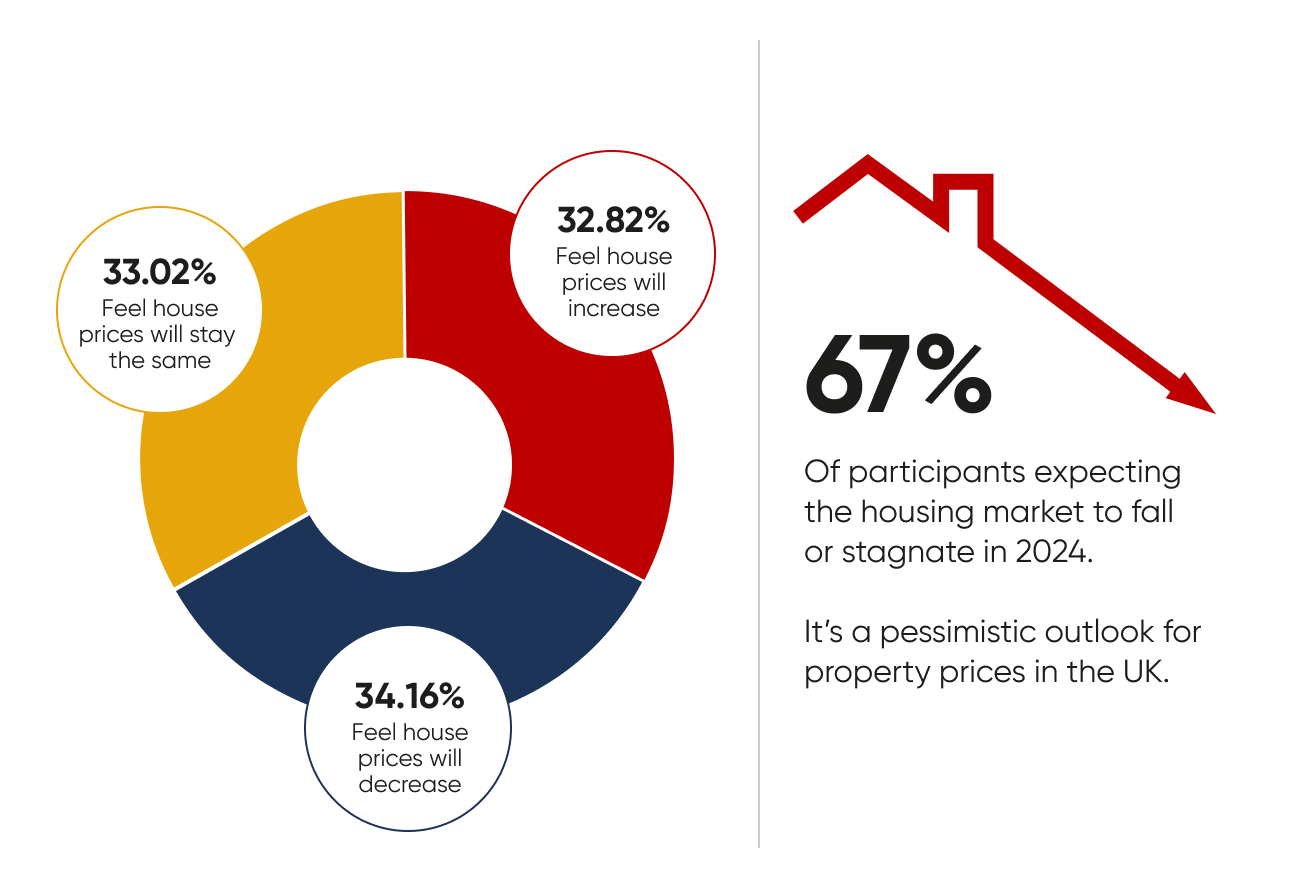

3 in 4 don’t think house prices will increase in 2024

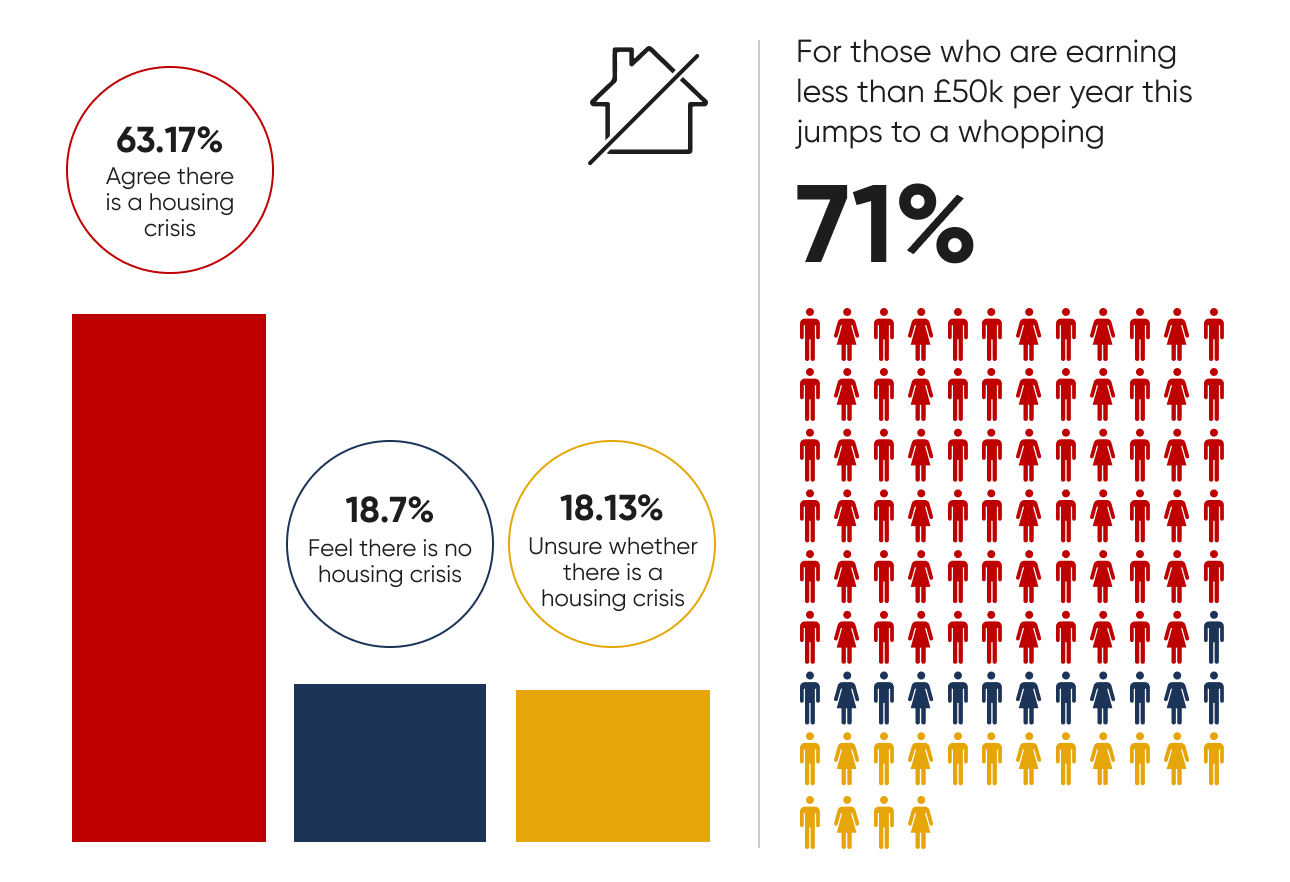

Over 60% of participants think the UK is facing a housing crisis

Over 85% of those surveyed don’t think interest rates will rise in 2024

Just 15% of participants believe interest rates will rise over the next 12 months, while 85% expect either a decrease or for rates to stay the same.

This sheds some light on the fixed or tracker mortgage debate for first-time buyers and those remortgaging in the next coming months.

George Abouzolof

Senior Finance Broker CeMAP

Inflation now sits at 2%, exactly the target that the Bank of England has been trying to achieve since 2021. Many were expecting the most recent bank rate announcement to reveal a reduction, but this hasn’t been the case.

Many individuals are holding their breath until they see a significant change to interest rates, and it’s possible that the Bank of England is waiting for inflation to drop below 2% in case inflation jumps up again with a large influx of spending following any base rate reductions.

The next inflation figures will be announced on 17th July, and if inflation drops further, I highly expect rates to reduce.

1 in 3 are worried about keeping up with their mortgage payments

Concern about meeting mortgage repayments in the next year is higher than expected, with 27% of people worried about keeping up.

It underscores the significance of the multiple consecutive interest rate hikes by the Bank of England over the last few years, and how it affects everyday borrowers.

George Abouzolof

Senior Finance Broker CeMAP

People are definitely worried – we see a clear concern about repayments among our clients every day.

As brokers, we look at every possible avenue to alleviate these struggles, whether it’s increasing the mortgage term, switching some or all of your mortgage to interest only, exploring offset mortgage options, and of course comparing lenders to get the most competitive deal.

3 in 4 don’t think house prices will increase in 2024

It’s a pessimistic outlook for property prices in the UK, with 67% of participants expecting the housing market to fall or stagnate in 2024.

George Abouzolof

Senior Finance Broker CeMAP

I always suggest looking at Nationwide's quarterly house price index for housing market insights.

The rate at which prices are falling is potentially reducing - remember, as rates drop, demand increases.

In terms of a housing crisis, there's an argument to be made that in a housing crisis, we should see house prices decreasing significantly - although we've seen drops recently, the rate of decrease is reducing, suggesting we're coming out of it.

Over 60% of participants think the UK is facing a housing crisis

It's a subjective and devising topic, but the numbers speak for themselves.

And this jumps to a whopping 71% of those who are earning less than £50k per year.

For more information, please contact: sam.hodgson@cliftonpf.co.uk