Categories

NEWS: Will House Prices Drop in the UK in 2025? [April 2025]

Will house prices go down in the UK? The Bank of England base rate has dropped, but interest rates haven't changed significantly - we explain why and how it affects UK house prices.

The 2025 housing market is off to a good start. Inflation has remained relatively stable since the Autumn Budget, currently 0.5% higher than the Bank of England's 2% target - and after nearly three consecutive bank rate reductions, lenders are finally starting to reduce rates.

The New Year has brought renewed optimism in the housing market, as many buyers aim to benefit from reduced lower mortgage rates, as well as get in ahead of April's Stamp Duty increases.

This increase in activity is likely to cause house prices to tick upwards, and estate agents are predicting house prices could increase by as much as 3.5% to £302,500.

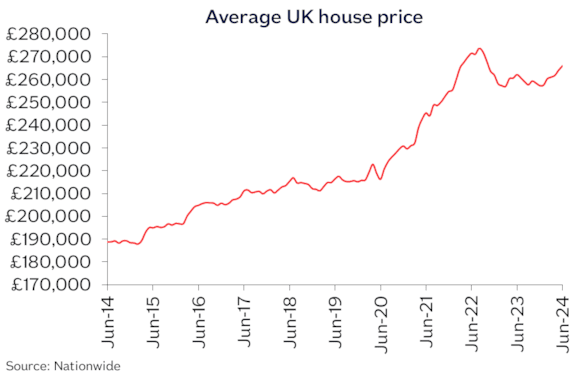

House prices have been subdued since 2022, in the face of high living costs and increased mortgage rates. But they're still over 50% higher than they were ten years ago.

Find the Perfect Mortgage

Leading up to the first base rate reduction to 5% in August, a number of lenders dropped rates to below 4%, some of the lowest rates available since borrowing was uber-low in 2020-2021. However, economic uncertainty brought on by legislation changes in the UK and the US election, lenders have hiked product rates.

Most analysts believe that this economic uncertainty will be short-lived, and lenders will lower rates again in the coming months, but alongside the usual homebuying slump in the lead-up to Christmas, it's possible that house prices will drop in 2025.

This is primarily due to higher mortgage rates further constricting affordability, an issue that has been prevalent since the Bank of England base rate was increased in 2022 in response to high inflation.

Inflation has certainly slowed now in comparison to where it was in 2022 (when it surpassed a whopping 11%), and the overall market outlook seems to be more positive than it has been for the past two years. But with mortgage product rates still relatively high, activity has been subdued, and this means price growth will slow down.

Despite this, estate agent Savills predicts that house prices will grow by over 23% in the next five years, with the North seeing the biggest jump.

Key Takeaways

- It's likely house prices could rise by as much as 3.5% in 2025

- The bank rate has dropped 3 times since August 2024 with mortgage rates set to follow

- Lower mortgage rates will lead to more purchasing activity - causing house prices to trend upwards

Skip to:

Why Could House Prices Go Down?

Will House Prices Continue to Fall in 2023?

What Markets Are Buyers Trending Towards in the UK?

How Will First-Time Buyers Be Affected?

How a Mortgage Broker Can Help

What's the Context?

High interest rates, escalating inflation, and the cost-of-living crisis caused a slump in the market that lasted the majority of 2023. Mortgage interest rates put a squeeze on affordability, and rents went up, making it more difficult to get on the housing ladder as a first-time buyer. Similarly, limited rental yields and new legislation surrounding buy-to-lets means that a number of landlords are selling their rental properties.

Between limited buying activity, a number of landlords leaving the market, and some homeowners downsizing larger properties in favour of more affordable homes, the housing stock increased, and the price of homes began to fall, particularly in more expensive areas like London and the South East. According to data by Propertymark, 76% of properties sold below asking price in September 2023.

In 2023, the UK saw its first annual drop in property prices in over ten years. Research by Zoopla revealed that property prices dropped across 80% of the UK.

Despite this, experts predicted that interest rates would come back down and the housing market would slowly return to normal. Activity has certainly been subdued in 2024, but in the face of inflation being successfully reduced to the Bank of England's 2% target and the Bank of England base rate reduced to 4.75%, activity has picked back up, and house prices are seeing a renewed vigour, reaching a two-year high in August.

COVID-19, the mini-budget and the war in Ukraine have all contributed to driving up inflation in the UK. In an attempt to tackle it, the Bank of England held the base rate at 5.25% for just under a year. This pushed up monthly mortgage payments for homeowners and put strain on households already struggling with the elevated cost of living. Because of this, fewer people could buy a home or invest in an additional property. The limited number of buyers meant property value declined and it became a buyer's market.

For some, homes becoming more affordable is welcome news, however, property value falling on a long term basis won't be good for many homeowners with large mortgages and investments tied up in equity.

In this post, we offer expert insights on what to expect regarding house prices in the final months of 2024 how the Bank of England base rate affects the entire market.

Related: Average Mortgage Repayments Up 60% Since 2021

The house price index (HPI) graph below shows how the average house prices have dropped year-on-year since 2022.

Until last August, the Bank of England base rate was at its highest in 15 years, and while this has succeeded in reducing inflation, homes are still costly for buyers due to relatively high mortgage rates.

This movement has already begun to push inflation back up slightly, so it hasn't been ruled out that the Bank of England could increase the base rate again to avoid it getting out of hand as it did in 2022 - which would likely cause another slump. However, while the high costs caused prospective buyers to hold their breath last year, a number of first-time buyers entered the market in 2024 despite similar market conditions. It may be that some buyers are tired of waiting and are doing what they can to get on the property ladder in the face of limited affordability.

Many industry experts had an optimistic outlook on the housing economy for the rest of 2024. While economists watch inflation warily, there is scope for another base rate reduction before December 2024. If this happens, the additional movement from the market will cause house prices to jump upwards further.

While homebuyers weren't able to enjoy falling house prices due to high mortgage costs this year, falling mortgage rates and financial forecasts suggest that there may be an upcoming reprieve.

As the market shifts, we're seeing buyers still priced out of expensive areas as they look to more affordable alternatives. House prices are picking up, particularly in more affordable areas in the North East, but a fifth of homes are still being sold below asking price, so if you're a buyer, there are still bargains to be had.

Why Could House Prices Go Down?

Generally, numerous factors cause a falling house price trend – here are 4 of the most relevant for 2024:

Economic Downturn

A recession will lead to a decrease in demand for housing, which can cause house prices to decline.

Supply and Demand

With affordability becoming paramount, buyers are looking towards affordable urban areas as opposed to historically expensive regions such as central London or desirable rural areas. A lack of demand will drop house prices as buyers continue to be priced out.

Higher Interest Rates

When borrowing is more expensive, the number of people who can afford a home reduces, lowering overall demand. Interest rates are on the up, meaning mortgages are becoming more costly despite falling house prices.

Negative Market Sentiment

With the widespread belief that the housing market is in a downturn, we could see a continual slump and decrease in demand for housing and reduced house prices. However, certain areas may be affected by negative sentiment more than others.

Read blog: Moving to the South West from London

Will House Prices Drop in 2024?

As the market shifts, buyers are still priced out of expensive areas as they look to more affordable alternatives. But in these expensive areas, we've seen a trend of homes being sold below the asking price, compounding the overall downturn in house prices across the UK.

Housing bubbles have popped up across the country, such as those in Manchester, Cornwall, and Bradford, and these markets behave differently from areas like Central London.

Research from Rightmove suggests that:

-

Lenders are confident in the long-term property market, as indicated by the release of 100% mortgage products with longer-term fixed rates.

-

The property market is exceeding many expectations, offering a positive landscape for both vendors and landlords to capitalise on the high demand for properties and rentals.

Related: NEWS: What Will My Mortgage Go Up To In 2023?

What Markets Are Buyers Trending Towards in the UK?

Zoopla's data suggested a trend is forming for affordable housing markets in 2024, as buyers favour cities over coastal or rural areas and the Central London market, of which many are now priced out.

Certain areas in the UK are poised to see some growth based on the affordability of houses in the area and their employment base.

The reason for a shift to urban areas lies in transactional data gained from expensive housing markets, which shows a trend of homes selling below the asking price.

This has been a significant factor for the downturn in previously desirable areas as buyers shift towards more affordable alternatives. Because of this, affordable urban areas could see less of an impact on house prices overall compared to the rest of the country.

Yet, it's still important to consider that these affordable markets have still felt the pang of higher interest rates.

How Will First-Time Buyers Be Affected?

First-time buyers must have their expectations measured in light of the recent house price dip. Despite falling property prices, mortgages remain expensive for those attempting to leap onto the property ladder.

This also isn't helped by certain lenders pulling out of the government guarantee scheme aimed at helping first-time buyers with a large LTV (Loan-to-Value) and a small deposit despite it being extended into 2023. Most importantly, however, interest rates remain high, which counterbalances the drop in property prices.

This fact alone can bar the way for many first-time buyers – not to mention that the affordability gap between renting and owning a home is becoming ever closer, making it just as expensive to rent as it is to pay a monthly mortgage payment.

Because of this, Landlords across the UK (especially in more desirable areas) are raising tenants' rent to counteract their rising mortgage payments.

Rents rose by 5.1% between 2022 – 2023, according to the Office for National Statistics, and are set to rise by up to 5% in 2024.

Compare rates and get an instant quote using our online mortgage calculator

While you're here, check out our video on our top tips on how to get a bigger mortgage:

Looking for a More Affordable deal?

Looking to buy or refinance in 2024? Working with a mortgage expert can ensure you get the best deal for your circumstances. A mortgage adviser can provide you with all your options in an often confusing and increasingly competitive market.

At Clifton Private Finance, we have long-term relationships with high street, private and specialist lenders. Our brokers use their expert knowledge of the market to match you with the most suitable deal that aligns with your long term financial goals. We can guide you through the application process, take care of the bulk of the paperwork, and liaise with lenders on your behalf.

Do you need to move faster to secure your dream home?

A bridging loan puts you in the position of a cash buyer, with short-term property finance available in as little as a few days. It’s then repaid when an ongoing sale completes, or when you secure a standard mortgage in its place.

To see what we can do for you, call us on 0117 959 5094 or book a consultation with us below.