Categories

Labour’s Housebuilding Boom – Fact or Fantasy?

Labour has lofty ambitions for the housebuilding sector over the next four years, but is their plan enough to tackle the housing crisis?

This year, the Labour government unveiled a sweeping plan to tackle the UK’s housing crisis. It promises to build 1.5 million homes over five years, reintroduce local housing targets, and promote social housing on an unprecedented scale.

However, with high mortgage rates dampening demand, accusations of monopolisation among major housebuilders, and an overstretched construction workforce, questions remain over whether these ambitious targets can be met. Critics warn that without careful planning and infrastructure investment, the drive for rapid development risks compromising housing quality and sustainability, potentially passing on costs to future generations.

The UK’s housing crisis is back in the spotlight, with the Labour government unveiling ambitious plans to build 1.5 million homes over the next five years. Yet, as the debate over housing policy intensifies, questions remain about how these proposals will translate into action and whether they can resolve deep-seated issues in the sector.

Related: Autumn Budget 2024: What it Means for Your Mortgage

What's the Context?

The new government has committed to increasing the national annual housing target from 300,000 to over 370,000 homes. This includes pledges to prioritise social housing, reintroduce local housing targets, and accelerate development on certain green belt areas reclassified as “grey belt.”

It also aims to facilitate the construction of new towns, with Northstowe in Cambridgeshire singled out as a flagship project.

Deputy Prime Minister Angela Rayner has vowed to deliver the “biggest wave of council housing in a generation”, framing the initiative as essential for reducing skyrocketing housing costs and improving affordability for young people.

While government policy can set the framework, the pace of housebuilding is heavily influenced by economic conditions. High interest rates discourage major housebuilders from ramping up production. As a result, the number of homes built in the UK closely correlates with GDP rather than political mandates.

The UK’s largest housebuilder, Barratt Developments, recently reported a decline in completions and announced plans to scale back further next year. Citing high mortgage rates, cost-of-living pressures, and waning consumer confidence, Barratt’s move reflects broader industry caution.

A number of professionals have accused large developers “land banking” — sitting on approved sites until market conditions maximise their returns, but these claims have been denied. But many do argue that monopolisation by a few major firms suppresses competition and keeps prices artificially high.

And how about our readers?

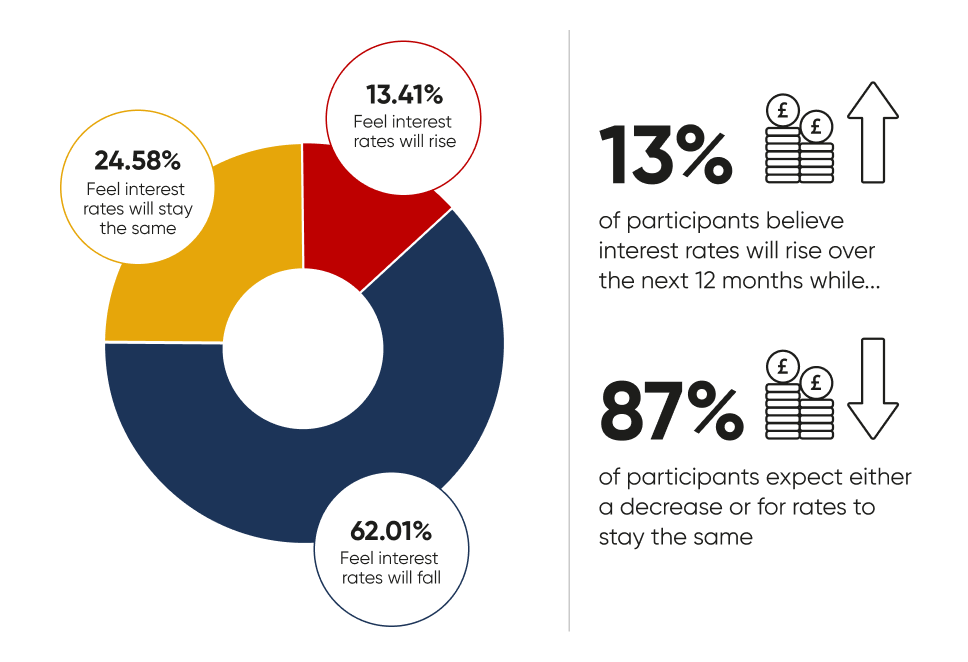

Just 13% of participants believe interest rates will rise over the next 12 months, while 87% expect either a decrease or for rates to stay the same.

This sheds some light on the fixed or tracker mortgage debate for first-time buyers and those remortgaging in the next coming months.

This sheds some light on the fixed or tracker mortgage debate for first-time buyers and those remortgaging in the next coming months.

Read our full survey results »

Supporting Smaller Builders

One potential solution lies in empowering small and medium-sized enterprises (SMEs) within the construction sector. These firms, which tend to enjoy greater local support, could challenge the dominance of large developers. Some industry experts have called for more government support, warning that without intervention, the SME sector could disappear altogether.

Labour’s proposals do include boosting support for smaller housebuilders, which could diversify the market and increase competition, but what this support will look like has not yet been specified. Addressing bureaucratic delays and regulatory costs could also be critical to creating a more dynamic housing market.

Balancing Quantity with Quality

The scale of Labour’s plans also raises concerns about whether the housing boom could compromise quality. Angela Rayner has acknowledged the controversy surrounding proposals to build on green belt land but insists that prioritising brownfield sites and promoting sustainable development will mitigate environmental impacts.

Some critics warn that rushed planning reforms could lead to poorly designed communities and substandard housing that fails to meet the UK’s net-zero targets. Ensuring developments align with biodiversity goals and flood-risk standards will be essential to avoid long-term costs for future homeowners.

A number of industry professionals argue that deregulation is not the way to achieve sustainable, high-quality developments, particularly when factoring in climate change and the UK's commitment to Net-zero.

Urban planning experts at Manchester University argue that expanding training for construction workers, building inspectors, and planners is essential to reforming housing development and upgrading infrastructure such as transport networks and the electricity grid.

Is There Enough Labour to Go Around?

With the construction sector already grappling with skills shortages, the rapid pace of development could strain resources further. Regional disparities are another concern, particularly in the South East, where the demand-supply gap is most acute.

Labour shortages could lead to regional wage inflation, potentially driving up construction costs. To mitigate this, the government must prioritise training new workers, retraining those in other sectors, and attracting back individuals who have left the industry.

Tackling the Rental Market

Labour’s plans extend beyond homeownership to address challenges in the rental market. The government has pledged to reintroduce a version of the Renters Reform Bill, making it harder for landlords to evict tenants and increasing protections for renters. However, these measures could inadvertently push some landlords out of the market, exacerbating rental shortages and driving up costs.

The Royal Institution of Chartered Surveyors (RICS) reports rising tenant demand and declining landlord participation, with 38% of professionals predicting rental price increases in the coming months. Balancing tenant protections with policies that retain landlord engagement will be crucial.

What Does the Greenbelt Have to Say?

Labour’s housing targets have sparked debate over regional disparities. Wiltshire Council’s Conservative leader, Richard Clewer, criticised plans to impose higher targets on rural areas while cities like London continue to build below their needs. Clewer argued that rural England should not shoulder the burden of meeting national housing goals.

Such criticisms highlight the importance of tailoring housing policies to regional needs. In areas like Wiltshire, ensuring new developments are well-integrated into existing communities and infrastructure will be vital.

What's Next?

Despite its criticisms, the government's new housing agenda has injected fresh momentum into addressing the UK’s housing crisis.

The base rate has decreased twice this year, so borrowing is cheaper, and mortgage rates are coming down. Optimism about the housing market’s recovery is growing. A survey by RICS revealed that 20% of professionals expect a rebound in home sales, the highest level of confidence since early 2022.

However, success will depend on more than just building homes. Addressing structural issues, from monopolisation to labour shortages, will be critical. The government’s ability to implement reforms thoughtfully and collaboratively will determine whether Labour’s ambitious vision can become a reality.

A new government with new focus points brings hope for improved market conditions, but translating promises into tangible benefits for both consumers and developers will require sustained effort and a watertight strategy.

Related: What is a Professional Mortgage and Can You Get One?

How Can You Find an Affordable Mortgage in 2024?

Despite current optimism about declining mortgage rates, deciding on the best option can be daunting and confusing.

We can help you compare mortgage products and their cost to find the best deal based on your specific situation from a wide range of lenders nationwide.

Expert mortgage advisors have their finger on the pulse of the latest mortgage market news. Whether you're a first-time buyer or looking to refinance or invest in a BTL, we can help you understand your mortgage options so you feel confident you're making the right choice.

To see what we can do for you, give us a call at 0203 900 4322 or book a free consultation below.