Categories

NEWS: Latest Mortgage Rates

With the BoE increasing the base rate to 4% last week, we look at the latest rate changes across the mortgage market.

This week, Nationwide reduced their fixed rate mortgage rates by up to 0.75% across certain products.

HSBC are also now offering the first 5 year fixed rate mortgage under 4% interest since before the mini-budget in September last year.

And Virgin Money have followed the trend, now offering a 5 year deal starting from 3.99% (with a £1,495 fee).

What are the latest mortgage rate updates?

Are these the best rates on the market?

What are the latest mortgage rate updates?

The key changes we’ve seen across the market this week are from:

- HSBC

- Nationwide

- Virgin Money

Arguably the biggest news was HSBC’s low-rate five year fix at just 3.99%.

What’s the criteria?

- You need a 40% deposit (it’s only available for up to 60% LTV)

- It’s for remortgages only (you’ll pay slightly more for a new mortgage)

- Maximum loan of £5m

There’s also a £999 booking fee, and an overpayment allowance of 10%.

Are these the best mortgage rates on the market?

Not necessarily – it depends on your situation.

While HSBC is the first bank to offer a 5 year fix below 4%, it doesn’t necessarily mean it’s the best deal for you.

Firstly, a 5 year fix isn’t for everyone.

In fact, we’ve seen a surge in the popularity of tracker mortgages in recent months, as people are hedging their bets against interest rates gradually falling over the next few years.

A 5 year fixed would certainly protect you from rates rising further (and with inflation still around the 10% mark, it’s certainly possible).

But on the other hand, if rates go down, you could find yourself locked into a higher rate for the next 5 years.

Related: Should you get a fixed or tracker mortgage?

Secondly, the lowest rate mortgage provider for one product might not be the lowest for another.

Let’s say you:

- only have a 30% or 20% deposit

- need to borrow more than 4.5 times your income

- or perhaps you’re self employed and earn a portion of your income in a foreign currency

Different lenders have different criteria and lending limits for each product, and some are better than others for different scenarios.

The best mortgage and lender for one person is often not the best for the next.

Mortgage brokers are experts at finding the cheapest mortgage for specific situations, from the simplest of remortgages to the most complex of applications.

2 Year Tracker

Up To £5m

4.94% APR

2 Year Tracker

Subsequent rate 6.99%

LTV - 60%

APRC 8.4%*

Product Fee £999

Free standard valuation

Early redemption charges

As of 10th January 2024

5 Year Fixed

Up To £1.5m

3.89% APR

5 Year Fixed (Remortgage)

Subsequent rate 6.25%

LTV - 60%

APRC 6.1%*

Product Fee £999

Early redemption charges

As of 10th January 2024

2 Year Fixed

Up To £1.5m

4.44% APR

2 Year Fixed (Remortgage)

Subsequent rate 6.25%

LTV - 60%

APRC 6.1%*

Product Fee £999

Early redemption charges

As of 10th January 2024

Contact Us

Thank You for your interest - please complete the form below and a member of our team will be in contact.

Are mortgage rates going up or down?

Nobody knows for sure what the mid to long term mortgage market looks like at any one time, because so many factors (both national and global) affect it - from inflation to geopolitical conflicts, from the housing market to government policies (to name a few).

However, mortgage brokers have their finger on the pulse of mortgage interest rates – they’re comparing them daily and analysing the best advice to give their clients.

Our news piece on current mortgage rates is updated regularly with expert insight from our mortgage brokers to give you the best possible understanding of the current market.

It can help you decide if you should get a fixed or variable rate mortgage, and whether you should lock in for 2, 5 or more years.

And if you need help, you can book a free, no-obligation consultation with one of our mortgage advisers.

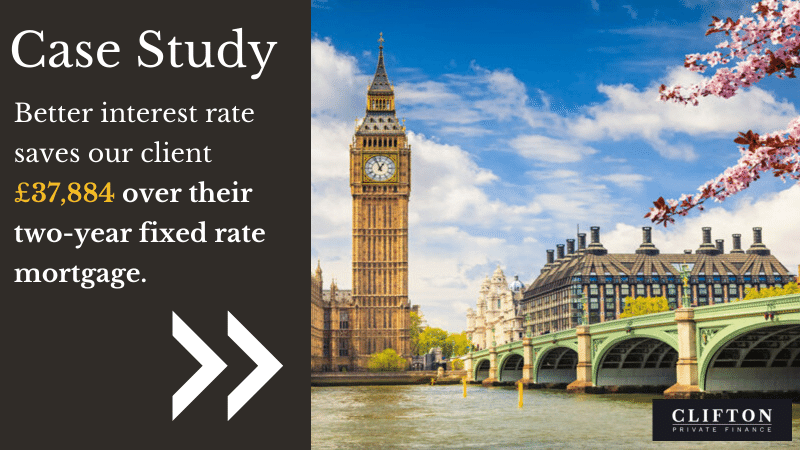

Here's an example of how we helped our client secure a low rate on their mortgage (and saved thousands of pounds in doing so):

How much can I borrow?

Need a quick recap on how much you can borrow towards a home? Use our free calculator tool:

Get in touch

We are a whole of market mortgage broker, so we compare rates across the entire industry.

Give us a call to talk about your options.