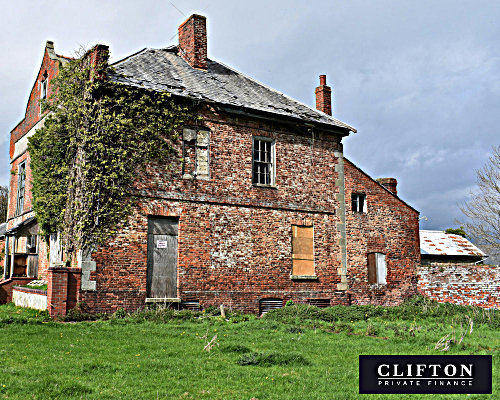

Bridging loan and exit onto mortgage for Staffordshire farmhouse renovation

Our clients had found a Cinderella project: a Grade II-listed traditional Staffordshire farmhouse with land and outbuildings. But… it had been standing vacant for a number of years, with the lead stolen from its roofs, and its copper plumbing stripped out. For finance, it was an interesting challenge.

The Scenario

Our clients could buy the property at a £50K discount on the £450K asking price if they could get finance set up reasonably quickly. They came to us looking for a mortgage.

There were a few lenders who might have taken this on as a mortgage proposition, but considering the state of the property, the rates would have been woundingly high.

When we reviewed the options we were able to show our clients that a bridging loan refinanced onto a mortgage would work out cheaper – even with set-up fees and costs.

The Solution

1 The bridge finance

We were looking for 75% LTV of the asking-price valuation, which would allow them to pay for the purchase, the cost of the works and the cost of the interest payments.

We took their case to a lender who provides bridging finance for both light and heavy residential refurbishment bridges (so if the project didn’t qualify as light, we wouldn’t need to go for another valuation with a different lender for heavy refurb finance).

We needed to push a bit to persuade the lender the works met their criteria for a light refurbishment (roofing works, new kitchen, plumbing…). The difference saved our clients 0.25% a month.

Bridging was arranged for a nine month term, with no exit fees, so they had sufficient time to do the work but could get off bridging rates ASAP.

2 The mortgage finance

When it came to setting up the mortgage as exit from the bridge, our clients had purchased an adjacent parcel of land and wanted to split the title. One title would have the farmhouse and the new land. The other title, with one of the barns and a strip of land, could be sold off.

We needed to find a mortgage lender who was prepared to consider a change of title, and whose valuation would be of the future configuration, not the present land division.

The lender we proposed is quite flexible and provides a free valuation. They also offer two alternatives for legal costs: either free legal services provided, or a £500 cashback towards the client’s legal fees.

We recommended the cashback deal and instructing a specialist solicitor who could handle the exit from the bridging loan and splitting the title.

We got them the 10-year fixed rate they wanted for a competitive 2.69%.

Read our blog with more details of the process »

Get started with our calculator

Get a Quote

James Ellacott

Commercial Finance Broker

Cardiff

0203 880 8890

Do you need help sourcing your own business finance?

I have extensive experience securing finance for a wide range of businesses. Book a free telephone consultation with me at a time to suit you.

Simon Mullins

Finance Broker CeMAP

Cardiff

0117 959 5094

Are you looking for a similar type of property finance?

As a specialist bridging adviser at Clifton Private Finance, I can take a holistic view of your situation and find the right finance solution for you. Book a free telephone consultation with me at a time to suit you.

Paige Dumpleton

Finance Broker CeMAP

Cardiff

0117 959 5094

Are you looking for a similar type of property finance?

As a specialist bridging adviser at Clifton Private Finance, I can take a holistic view of your situation and find the right finance solution for you. Book a free telephone consultation with me at a time to suit you.

Jonathan Moffatt

Head of Business Finance

Cardiff

0203 880 8890

Do you need help sourcing your own business finance?

I have extensive experience securing finance for a wide range of businesses. Book a free telephone consultation with me at a time to suit you.

Alex Morris

Private Client Adviser

Bristol

0117 332 5061

Do you need help sourcing your own property finance?

I have extensive experience securing UK mortgages for clients. Book a free telephone consultation with me at a time to suit you.

Scott Dutfield

Finance Broker

Cardiff

0117 959 5094

Are you looking for a similar type of property finance?

As a specialist bridging adviser at Clifton Private Finance, I can take a holistic view of your situation and find the right finance solution for you. Book a free telephone consultation with me at a time to suit you

Carly Cheeseman

Head of International

Bristol

0117 457 9922

Do you need help sourcing your own property finance?

I have extensive experience securing UK mortgages for clients. Book a free telephone consultation with me at a time to suit you.

Nick Kerley

Finance Broker

Cardiff

0117 959 5094

Are you looking for a similar type of property finance?

As a specialist bridging adviser at Clifton Private Finance, I can take a holistic view of your situation and find the right finance solution for you. Book a free telephone consultation with me at a time to suit you.

Specialist Car Finance

Broker Finance Team

Bristol

0203 900 4322

Do you need help sourcing car finance?

Speak to our finance team or book a team to speak that suits you.

Book ConsultationBusiness Finance

Business Finance Broker Team

Bristol

0203 880 8890

Do you need help sourcing business finance?

We have extensive experience sourcing unsecured and secured finance for businesses. Book a free telephone consultation with our business loans broker team at a time to suit you.

Mortgages & Short Term Finance

Mortgage Broker Team

Bristol

0117 959 5094

Do you need help sourcing a UK mortgage?

We have extensive experience securing 1st and 2nd charge mortgages. Book a free telephone consultation with our mortgage broker team at a time to suit you.

7 Reasons why you should use a specialist mortgage broker »

Book ConsultationDevelopment Finance

Broker Team

Cardiff

0117 959 5094

Do you need help sourcing UK property finance?

We have extensive experience securing UK development finance. Book a free telephone consultation with our team at a time to suit you.

Expat and Foreign National Mortgages

Broker Team

Bristol

+44 203 900 4322

Do you need help sourcing UK property finance?

We have extensive experience securing UK mortgages for clients based outside the UK. Book a free telephone consultation with our team at a time to suit you.

Louis Levine

Finance Executive CeMAP

Bristol

0117 457 7862

Are you looking for a similar type of property finance?

Get in touch today and find out how I can help.

George Abouzolof

Senior Finance Broker

Bristol

Do you need help sourcing your own property finance?

I have extensive experience securing UK mortgages for clients. Book a free telephone consultation with me at a time to suit you.

Bridging Team

Clifton Private Finance

Bristol

0117 959 5094

Are you in need of a similar type of property finance?

Book a free telephone consultation with one of our bridging specialists today and see how we can help you.

Book ConsultationSam Baker

Finance Broker

Cardiff

0117 959 5094

Are you looking for a similar type of property finance?

As a specialist bridging adviser at Clifton Private Finance, I can take a holistic view of your situation and find the right finance solution for you. Book a free telephone consultation with me at a time to suit you.

Fergus Allen

Head of Bridging Finance

Cardiff

0117 959 5094

Are you in a similar situation? I specialise in bridging finance at Clifton Private Finance - I will find you the best funding solution for your property transaction.

Book a free telephone consultation with me at a time to suit you.

Book ConsultationJacob Phipps

Finance Broker

Bristol

(+44) 0117 959 5094

Are you looking for a similar type of property finance?

I specialize in helping international clients source residential and investment property finance for UK property. Book a free telephone consultation with me at a time to suit you.

Book ConsultationJack Spillane

Finance Broker

Bristol

0117 959 5094

Mathew Phillips

Senior Finance Broker

Bristol

0117 959 5094

Are you in a similar situation? I specialise in bridging finance at Clifton Private Finance - I will find you the best funding solution for your property transaction.

Book a free telephone consultation with me at a time to suit you.

Book ConsultationAlex Chambers

Senior Private Client Adviser

Bristol

0117 403 4324

Are you in a similar situation? I am a specialist in residential and investment property finance for UK and international clients at Clifton Private Finance. Please don't hesitate to get in touch for a no-cost discussion of the finance you need.

Book a telephone consultation at a time that suits you.

Book ConsultationLuther Yeates

Senior Finance Broker

Bristol

0117 244 5561

Are you looking for a similar type of property finance?

I have extensive experience finding residential and investment property finance for UK and international clients. Book a free telephone consultation with me at a time to suit you.

Book ConsultationBridging Finance Team

Clifton Private Finance

Bristol

0117 959 5094

Are you in need of a similar type of property finance?

Book a free telephone consultation with one of our bridging specialists today and see how we can help you.

Book Consultation