Best ways to finance a Tesla car purchase in the UK

For buying and refinancing Tesla cars

High quality Tesla finance solutions for UK & international clients.

- Finance from £50,000 for individuals and £25,000 for business purchases

- Competitive car vehicle finance that often outperforms in-house car dealer offers

- Flexible finance options which includes: Personal loans, Personal contract Purchase (PCP), Hire Purchase, Lease Purchase

- Tailored bespoke service

- Refinance options

- Flexible repayment periods

- Finance available on new, used and auction bought Tesla cars

- Business owners - Refinance existing assets to free up your company's liquid capital

- Business owners - Cashflow matched repayments

- Asset finance for prestige cars

We can deliver enhanced, bespoke or exclusive terms through our market knowledge.

Call us on 0203 900 4322 to discuss your requirements or book a free consultation below.

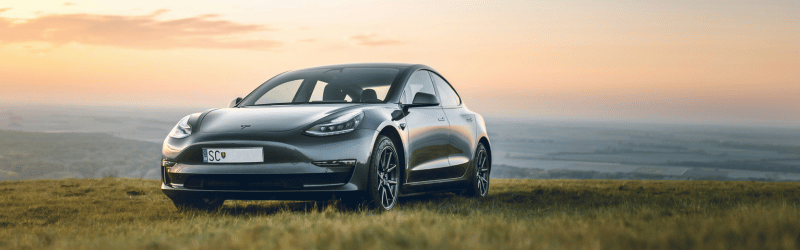

A Tesla car can be an excellent asset for individuals or businesses looking to acquire a pioneering electric vehicle. Read our guide to learn how to purchase a Tesla in the UK and the types of asset finance that work best for different models.

Purchasing a Tesla Car with Asset Finance

Many business owners opt for asset finance solutions when purchasing an expensive asset, such as a Tesla car. When making acquisitions which require significant funding, asset finance is a great alternative to buying outright in cash. For example, a state-of-the-art piece of equipment, machine or vehicle may cost a company £50,000 to purchase outright.

In this instance, a business owner may decide to arrange an asset finance plan with the vendor. Asset finance is different to a business loan from a bank. You will be able to spend the loan (say, £50,000) as you please. However, your eligibility for a bank loan depends on your annual revenue, net income, collateral and credit score.

Conversely, asset finance enables you to acquire a loan for a specific asset. The asset will belong to the vendor until you have paid back the loan. Failure to keep up with repayments may cause Tesla to repossess the car.

Why Use Asset Finance to Buy a Tesla Car?

Since the launch of the ‘Roadster’ model in 2008, Elon Musk, business magnate and CEO of Tesla, has propelled Tesla cars to the forefront of the electric vehicle market. All Teslas are fitted with basic integrated autopilot functionality, with the higher-end Tesla Model S and Model X offering advanced self-driving software.

Due to their world-renowned EV status, you can expect to pay upwards of £48,000 for a new Tesla car. This is a substantial singular purchase for any individual or business. For this reason, using asset finance to buy a Tesla can help to protect your cash flow when making a sizeable acquisition.

Similar to a repayment mortgage, your loan will be secured against the physical asset of the Tesla car. You will make monthly repayments to gradually pay off your loan through your asset finance plan.

Key Differences Between Tesla Models

Rather than selling out of garages like its legacy brand competitors, Tesla offers a handful of ‘stores’ around the UK so that customers can see the electric vehicles in person. Nonetheless, Tesla car purchases must be made through the Tesla website. As of 2021, there are four Tesla models available in Britain.

The main differences between each Tesla model are as follows:

Tesla Model 3

| Standard | Long Range | Performance | |

| Style | 5-seat compact sedan | 5-seat compact sedan | 5-seat compact sedan |

| EPA range (miles) | 305 | 374 | 340 |

| Transmission | Rear-wheel drive | All-wheel drive (dual motor) | All-wheel drive (dual motor) |

| RRP | £48,490 | £57,490 | £61,490 |

| Features |

|

Tesla Model Y

|

|

Standard | Long Range | Performance |

|---|---|---|---|

|

Style |

5-seat compact crossover SUV |

5-seat compact crossover SUV |

5-seat compact crossover SUV |

|

EPA range (miles) |

283 miles |

315 miles |

303 miles |

|

Transmission |

Rear-wheel drive |

All-wheel drive (dual motor) |

All-wheel drive (dual motor) |

|

RRP |

£51,990 |

£57,990 |

£67,990 |

|

Features |

|

Tesla Model S

|

|

Standard | Plaid |

|---|---|---|

|

Style |

5-seat sedan |

7-seat sedan |

|

EPA range |

405 miles |

396 miles |

|

Transmission |

All-wheel drive (dual motor) |

All-wheel drive (tri-motor) |

|

RRP |

£55,935 |

£11,990 |

|

Features |

|

Tesla Model X

|

|

|

|

|---|---|---|

|

Style |

5, 6 or 7-seat SUV |

6-seat SUV |

|

EPA range (miles) |

348 miles |

333 miles |

|

Transmission |

All-wheel drive (dual motor) |

All-wheel drive (tri-motor) |

|

RRP |

£101,990 |

£109,990 |

|

Features |

|

Types of Asset Finance for a Tesla Car Purchase

There are many different methods of purchasing a Tesla car through asset finance. Remember that both the Tesla Model 3 and the Model Y are subject to a 2% Company Car Tax. Combined with the deposit, this tax may affect your budget.

Tesla-arranged options include hire purchase and contract purchase to finance a Tesla car. Their website provides additional details of the Tesla Finance Application Process. Additional asset finance options for buying a Tesla car include a personal contract purchase (PCP) or balanced payments plan.

Hire purchase

Also known as a lease agreement, a hire purchase is a car finance plan that permits you to acquire your asset through a loan. Once you have paid off your loan, you will own the Tesla car.

You will make your elected down payment of 10% to 80% of the car purchase price before you take delivery of the Tesla. Once it is in your hands, you will make monthly payments with a fixed interest rate for a 24 to 60 month term.

Hire purchase is one of the most popular car finance options for any Tesla model acquisition. This type of asset finance offers flexible deposits, unlimited mileage and complete ownership of the asset at the end of the contract term.

Hire purchase with balloon payment

This method of asset finance follows a hire purchase plan but allows for additional flexibility with repayments. You will make smaller monthly repayments on the premise that you will make a final balloon payment at the end of your contract term. Your balloon payment amount will be agreed upon before your contract begins.

This deferred lump sum payment allows you to save money and reduce your monthly outgoings. As an asset finance plan, hire purchase with balloon payment can be ideal for buyers seeking to buy a Tesla car with a high residual value, such as the flagship Tesla Model S or top-of-the-range Model X.

Balanced payments

Balanced payments are a type of asset finance that functions as a variable rate hire purchase. You will not have to make a large deposit and can enjoy fixed monthly repayment charges. However, the interest rate on your balanced payment car finance plan will be subject to any changes in the national interest rate.

This means that your monthly repayments will depend on the base rates of the Bank of England, Finance House or the London Interbank Offered Rate (LIBOR). Therefore, balanced payment plans are better suited to experienced investors or Tesla car collectors than first-time buyers.

Contract purchase

Similar to a hire purchase with balloon payment, buying a Tesla car through a contract purchase permits you to defer a large amount of credit to the final loan payment. The size of the final payment amount is derived from the projected value of the Tesla model, which is dependent on the term length and mileage.

Your contract term will last between 24 to 48 months with a fixed interest rate for 10,000 to 24,000 miles per year. The deposit will be between 10% to 30% of your Tesla car price. This asset finance solution presents several options when you reach the end of your contract term. Once you have made your final payment on your Tesla car loan, you can:

- Return the car to Tesla

- Buy the car at its guaranteed future value

- Refinance the guaranteed future value and take full ownership

- Trade in your car and draw on equity to purchase another car

It is recommended to opt for a contract purchase if you are certain that your Tesla Model has a high guaranteed minimum future value (GMFV). This means that a contract purchase may be a more suitable form of asset finance for a higher-end Tesla, such as the Tesla Model X or Model S.

Personal contract purchase (PCP)

Following the format of a contract purchase plan, a personal contract purchase (PCP) provides more flexibility than a hire purchase plan. The purpose of PCP as a car finance plan is to enable the buyer to upgrade to a new Tesla model 24 to 48 months into their contract term.

At this point in your contract, you can return your Tesla car, pay the GMFV to keep the car or get a part exchange. Through a part exchange, you will use your equity to switch to another Tesla model, thus renewing your contract.

It's not advisable to use a PCP asset finance plan for a Tesla Model S or Model X. This is because Tesla recently reduced the prices of their cars, which has left some early adopters with negative equity. With negative equity, you cannot use your equity to make a Tesla car upgrade.

Commercial Finance Case Studies

Read some of our latest commercial finance case studies for real-life examples of how we've helped businesses grow with varying finance solutions:

What Happens At The End of An Asset Finance Plan?

Once you have paid off the loan, you will either own the asset or have the option to purchase it, depending on the nature of your asset finance plan. This is when you decide whether to keep your Tesla car, return your EV to Tesla, or sell it yourself.

It is crucial to remember that Tesla is a far younger brand than its legacy competitors, constantly improving the quality and price point of its electric vehicles as the technology and manufacturing processes continue to develop. Consequently, the Tesla models released in 2019 have seen drastic improvements in recent years, such as upgrades to the battery recharge time and build quality.

Second-hand Tesla cars are currently facing steep depreciation, as older iterations of the electric vehicles presented issues with battery capacity, software and build quality. In this regard, a PCP or contract purchase may be a beneficial asset finance plan. You will be able to trade in your vehicle and part exchange your car for a newer Tesla model at a competitive price.

On the other hand, you could use a hire purchase plan to purchase a new Tesla car which offers better build quality, technology and battery life. A post-2019 Tesla may be a more lucrative car to own outright at the end of your asset finance plan than an older Tesla car.

Why Use a Finance Broker?

A finance broker can provide indispensable assistance in securing asset finance to purchase a Tesla car. Brokers can offer expert guidance and advice as you review your financial circumstances. They will help you decide which type of asset finance is best suited to you and your chosen Tesla model.

At Clifton Private Finance, we offer a specialist asset finance service for clients looking to purchase a Tesla car in the UK. We offer cash flow matched repayments and government-backed CBILS facilities without a set asset age limit. As an intermediary, your Clifton finance broker will work with Tesla to arrange your car finance plan and finalise your purchase.

The Clifton broker team can deliver bespoke, enhanced or exclusive terms to finance new, used or auction-bought assets. Our finance brokers can draw on their extensive market knowledge to secure the most competitive asset finance solution for your Tesla car purchase.

To see what we can do for you, call us on 0203 900 4322 or book a free consultation below.