Categories

Capital Employed Formula | Calculations Explained

There are a number of metrics that can be used to show a company’s efficiency and profitability. One example is capital employed which is used to calculate return on capital employed or ROCE. ROCE is a ratio that directly describes profitability.

So, what is the capital employed formula and what can it show us?

Table of Contents

What is Capital Employed?

The Capital Employed Formula

Putting Capital Employed to Use

Return on Capital Employed (ROCE)

Using ROCE to Analyse Your Business

Average Capital Employed and ROACE

Understanding the Terms

What is Capital Employed?

Also known as funds employed, capital employed is the total amount of capital the business has invested in itself.

As the business grows, the amount of capital employed will increase as equipment is purchased, more employees are retained, and property is bought.

In itself, capital employed doesn’t really tell us anything - larger companies will have larger amounts of capital employed. It is its use in calculating ROCE that provides its value as a measurable metric.

It is also possible to calculate capital employed for a single project, enabling analysis of that project’s value independently of the business as a whole.

The Capital Employed Formula

There are two common ways to calculate capital employed: the subtraction method and the addition method.

Both are equally valid, though depending on the accuracy of your balance sheet there may be a slight difference between the results. So, once you choose the formula that suits your data, be sure to continue to use the same method in subsequent years.

Subtraction Method

The first method is subtracting the current liabilities from total assets:

capital employed = total assets - current liabilities

Addition Method

The second is adding fixed assets to working capital:

capital employed = fixed assets + working capital

Both of these formulas are valid as working capital is essential current assets - current liabilities. In fact, expanding both formulas results in:

capital employed = fixed assets + current assets - current liabilities

As stated above, once you have chosen a method to calculate capital employed, ensure you use it with consistency.

Putting Capital Employed to Use

As said previously, alone, capital employed doesn’t provide a particularly useable statistic for analysis.

It does provide an estimate of the business’s assets that’s more accurate than the traditional total assets figure - merely because it also takes into account the current liabilities - but beyond that, it has little to offer without measuring it against other data.

The key metric for which capital employed is invaluable is that of ROCE.

Return on Capital Employed (ROCE)

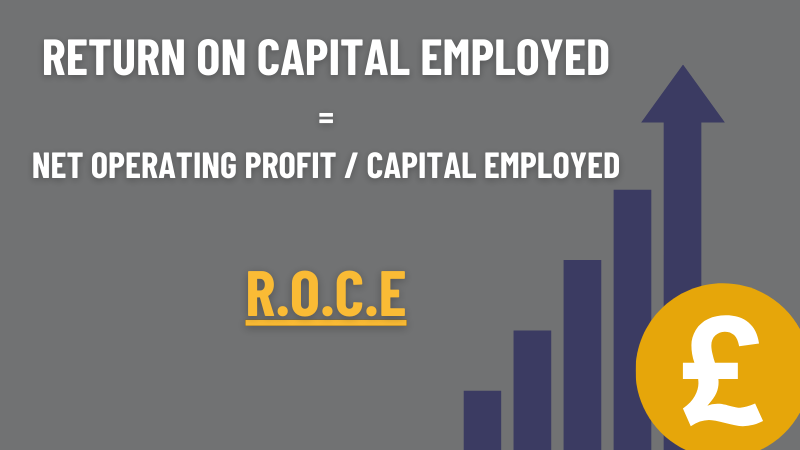

Return on Capital Employed (ROCE) is a ratio (written as a percentage) that describes the profitability of the business.

It is calculated by dividing net operating profit (also known as EBIT or earnings before interest and tax) by capital employed:

return on capital employed = net operating profit / capital employed

The higher the ROCE, the more profit the company is making on the invested capital.

Using ROCE to Analyse Your Business

What is a good ROCE ratio, and what is a bad one?

A lot can depend on the industry your company is in, and measuring your ROCE against competitors is an excellent way to determine if you are doing well. This difference between industries is due to the different nature of company assets; for example, in the manufacturing industry fixed assets of specialist machinery will increase capital employed, while retail industries may have larger current liabilities due to supplier payments.

ROCE is used by investors to ascertain the value of investing in a company and the returns they can expect. As it takes long-term financing into consideration it is a preferable metric to some alternatives, such as return on assets or return on equity. Higher ROCE values show that the company is efficient and profitable.

Return on capital employment can also be analysed over time, comparing ROCE results for year-on-year to evaluate the growth of business profit and efficiency. Company ROCE values can also be compared against other competitors in the same sector, allowing investors and business owners to evaluate the company against others in a similar field.

The ROCE can be seen in a simple way as the amount of profit generated for each £1 of capital investment. Thus, a ROCE of 24% represents 24 pence of profit for every £1 invested in assets.

Average Capital Employed and ROACE

One additional metric used is that of average capital employed and, by extension, return on average capital employed (ROACE). By calculating the mean average of ROCE over a period of years, a ROACE value is determined.

This can be beneficial as it takes into account multiple factors that affect the value of assets over time, including depreciation.

Using the Capital Employed Formula with Clifton Private Finance

At Clifton Private Finance, we work with businesses across the UK to support growth and investment.

As specialist business finance brokers with developed relationships across the UK marketplace of banks and other lenders, we are expertly placed to obtain many different forms of business finance to help support your business, grow your business assets, and manage your current liabilities to ensure strong capital employed and ROCE metrics.

Contact us today to discover how we can help you improve profitability and efficiency.

Understanding the Terms

Q: What are total assets?

A: Total assets combines your fixed assets with your current assets.

Q: What are fixed assets?

A: Fixed assets are longer term assets that you expect to still have (and be using) after a year, for example, machinery, property, and other equipment. Fixed assets are sometimes known as PP&E or property, plant, and equipment.

Q: What are current assets?

A: Current assets are short term assets that are expected to be used or converted into cash within a year. For example: cash, accounts receivable (the amount customers owe you), and stock.

Q: What are current liabilities?

A: Current liabilities refers to the short-term financial obligations of the company. It includes accounts payable (the amount you owe suppliers), short-term debt, interest on all outstanding debts, and taxes for the current year.

Q: What is working capital?

A: Working capital (or net working capital) is your current assets minus your current liabilities.

.png)